In Pakistan, navigating through tax systems might seem like a daunting task, especially for beginners. Whether you’re an individual looking to comply with tax regulations or a business seeking growth opportunities, obtaining an NTN number (National Tax Number) is a critical first step.

In this comprehensive guide, we will walk you through the entire process of getting an NTN number, explain its importance, and answer common questions to make the procedure as simple and stress-free as possible.

What is an NTN Number?

An NTN number is a unique identifier issued by the Federal Board of Revenue (FBR) in Pakistan to individuals, businesses, and companies for tax-related purposes. It is like a personal ID for taxpayers that enables them to file returns, pay taxes, and benefit from government services.

Who Needs an NTN Number?

You need an NTN number if:

- You’re earning a taxable income as an individual.

- You own a business or are self-employed.

- You’re part of a registered company.

Why is the NTN Number Important?

Having an NTN number is more than just fulfilling a legal requirement; it opens up numerous opportunities:

- Tax Filing: You can file your income, sales, and withholding taxes.

- Business Operations: Necessary for opening a corporate bank account, participating in tenders, and conducting formal trade.

- Legal Compliance: Avoid penalties by staying compliant with tax regulations.

Whether you’re a salaried employee, freelancer, or entrepreneur, the NTN number is your gateway to financial transparency and growth.

Step-by-Step Guide to Getting Your NTN Number

The process of acquiring an NTN number has become simpler, thanks to the FBR’s digital systems. Follow this step-by-step guide to ensure you meet all the requirements.

Step 1: Determine Your Eligibility

Before proceeding, confirm whether you’re required to register for an NTN number:

- Individuals with a taxable income or earning over PKR 600,000 annually.

- Businesses, whether sole proprietorships, partnerships, or companies.

- Freelancers and online sellers earning taxable income.

Step 2: Gather Required Documents

Having the right documents ready will save you time during the application process:

-

For Individuals:

- Copy of CNIC (Computerized National Identity Card).

- Proof of address (utility bill, rental agreement, or ownership documents).

- Active email address and phone number.

-

For Businesses:

- CNIC of the business owner.

- Proof of business registration (partnership deed or incorporation certificate).

- Business address details.

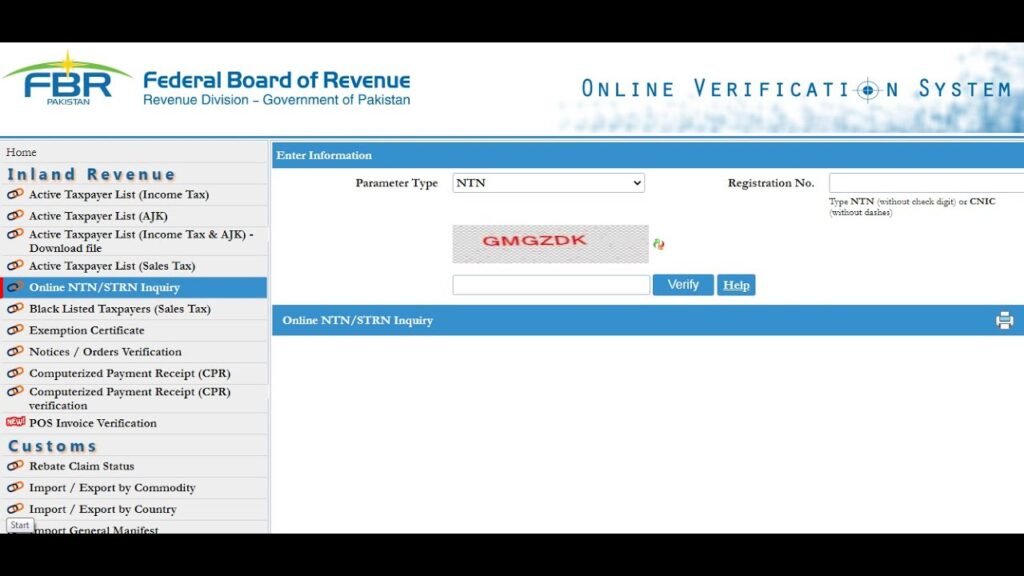

Step 3: Register on the FBR IRIS Portal

The Federal Board of Revenue (FBR) has introduced a user-friendly online platform called IRIS, simplifying NTN registration. Follow these steps:

-

Create an Account:

- Visit the official FBR IRIS portal.

- Click on Registration for Unregistered Person.

- Fill in your CNIC number, contact details, and email address.

- Verify your email and phone number through the codes sent by FBR.

-

Log in to Your IRIS Account:

- Use the credentials provided during registration to log in.

- Navigate to the “Registration” section and select NTN Registration.

-

Complete the Form:

- Provide your personal or business details, including income sources and address.

- Upload scanned copies of required documents (ensure they are clear and legible).

Step 4: Submit and Verify

After submitting your application:

- Verification by FBR: The FBR will review your documents and application details.

- Notification: Once approved, you will receive a confirmation email containing your NTN number.

The verification process can take 2–5 working days.

Common Challenges and How to Overcome Them

While the process is straightforward, some applicants encounter obstacles. Here are common issues and tips to resolve them:

-

Incorrect Information

- Double-check all details before submission. Errors in your CNIC number, email, or address can delay approval.

-

Document Issues

- Ensure your scanned documents are clear and meet the size requirements set by the portal.

-

Portal Errors

- If the website is down or not responsive, try accessing it during non-peak hours. Clear your browser cache if issues persist.

-

Verification Delays

- If your application is taking longer than expected, contact FBR through their helpline or visit the nearest tax office for assistance.

By addressing these challenges proactively, you can speed up the registration process and secure your NTN number without hassle.

FAQs About NTN Numbers

Do Freelancers Need an NTN Number?

Yes, freelancers earning taxable income must register for an NTN number to file taxes and comply with FBR regulations.

Is NTN Registration Free?

Yes, there is no fee for obtaining an NTN number. However, businesses might incur nominal costs for document preparation.

Can Someone Apply on My Behalf?

Yes, you can authorize a tax consultant or agent to apply for an NTN number on your behalf, provided they have the necessary documents and a power of attorney.

What Happens if I Don’t Register for an NTN Number?

Failure to obtain an NTN number or file taxes can lead to penalties, fines, or legal actions by the FBR.

Benefits of Getting an NTN Number

Obtaining an NTN number offers several advantages beyond compliance:

- Transparency: Demonstrates your commitment to fulfilling tax obligations.

- Ease of Business: Simplifies legal formalities such as account openings and government dealings.

- Eligibility for Benefits: Allows individuals and companies to participate in government tenders and claim tax refunds.

By obtaining an NTN number, you align yourself with national regulations while opening doors to growth opportunities.

Conclusion

Getting an NTN number in Pakistan is no longer a complicated process. With FBR’s digital IRIS system, the steps are straightforward and user-friendly. Whether you’re an individual taxpayer, a business owner, or a freelancer, having an NTN number is essential for financial and legal compliance.

Follow this guide to ensure a smooth registration process, and take the first step toward responsible financial management. If you have further questions or need assistance, don’t hesitate to reach out through the comments section below.

Remember, being tax-compliant not only benefits you but also contributes to the nation’s growth and development. Get your NTN number today and secure your financial future!