Zakat is one of the five pillars of Islam and an obligation for eligible Muslims. It ensures that wealth is purified and shared with those in need. If you own gold, knowing how to calculate Zakat on it is essential to fulfill this responsibility. In this guide, we simplify the process for you.

What is Zakat and Why is It Important?

Zakat is a mandatory charity in Islam, where 2.5% of a Muslim’s wealth must be given annually to the poor and needy. It serves as a means of redistributing wealth and helping communities prosper. For gold owners, understanding the correct calculation ensures they meet this religious obligation without mistakes.

Understanding Nisab: The Zakat Threshold

Before calculating Zakat, it’s crucial to check if your gold wealth reaches the Nisab threshold. Nisab is the minimum amount of wealth a person must possess to become eligible to pay Zakat.

The Nisab value for gold is 87.48 grams (or equivalent value in money). If the total weight of your gold meets or exceeds this, you must pay Zakat. Always verify the current gold price per gram in your country to calculate this accurately.

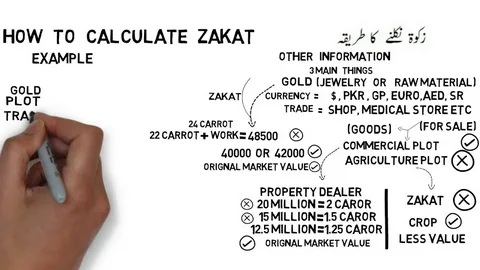

Types of Gold Eligible for Zakat

Not all gold items are treated equally when calculating Zakat. Here’s a breakdown:

- Gold Jewelry: Even gold jewelry that you wear daily is Zakatable, according to most scholars.

- Stored Gold: Gold that you save as an investment, including coins or bars, is also eligible.

- Mixed Gold: For gold mixed with other metals (like in jewelry), calculate Zakat only on the gold portion.

It’s important to weigh all the gold you own and exclude non-gold materials.

Step-by-Step: How to Calculate Zakat on Gold

Here’s a simple process to calculate Zakat on your gold:

- Step 1: Determine the Total Weight of Gold

Gather all your gold items (jewelry, coins, bars) and weigh them accurately. For mixed materials, estimate the gold portion only. - Step 2: Check the Current Gold Rate

Find the latest market price of gold per gram. This can vary daily, so ensure you’re using an up-to-date value. - Step 3: Calculate the Total Value

Multiply the weight of your gold (in grams) by the current price per gram.

Example: If you have 100 grams of gold and the price is PKR 12,000 per gram, the total value = 100 × 12,000 = PKR 1,200,000. - Step 4: Calculate 2.5% Zakat

Multiply the total value of your gold by 2.5% (0.025).

Example: 1,200,000 × 0.025 = PKR 30,000.

This is the amount of Zakat you need to pay on your gold.

Common Mistakes to Avoid

- Forgetting to include stored gold or investment coins.

- Ignoring the latest market price of gold.

- Miscalculating mixed-metal jewelry.

Always double-check your calculations to ensure you fulfill your Zakat obligation accurately.

Conclusion: Fulfill Your Duty with Ease

Calculating Zakat on gold doesn’t have to be difficult. By understanding the process, checking Nisab, and following the steps above, you can confidently determine your Zakat amount. Remember, Zakat purifies your wealth and benefits those in need.

If you’re unsure about calculations, consider using an online Zakat calculator or consult an Islamic scholar for guidance.